Bankrupt cryptocurrency lender Celsius Network has started allowing withdrawals of assets in certain custody accounts. The company stated in an earlier blog post that eligible users could withdraw all funds in their accounts up to a specific limit.

Silvergate Bank has announced it will be discontinuing its Silvergate Exchange Network (SEN), a platform used by institutions to move money to and from cryptocurrency exchanges.

Leading stablecoin issuer Tether has reportedly used shadowy intermediaries, falsified documents, and shell companies to regain access to the traditional banking system.´

Top stories in the Crypto Roundup today:

- Celsius Reopens Withdrawals for Some Custody Accounts

- Silvergate Bank Discontinues Platform Used to Move Money to Crypto Exchanges

- Tether Reportedly Used Falsified Documents to Open Bank Accounts

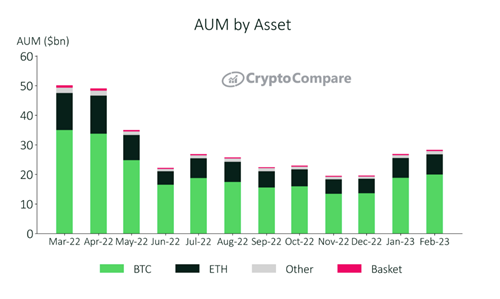

- Digital Asset Investment Products’ AUM Keeps Rising