Bankrupt cryptocurrency lender Voyager Digital has secured court approval to sell its assets and transfer its users to Binance.US, in a deal valued at $1.3 billion, though the firm still has to clear additional hurdles before the deal is finalized.

Embattled cryptocurrency-focused bank Silvergate Capital (SI) is in talks with officials from the Federal Deposit Insurance Corp (FDIC) to explore how the bank can stay in business, days after several crypto clients, including Coinbase, dropped its services.

The decentralized autonomous organization (DAO) behind the popular cryptocurrency-backed stablecoin DAI, MakerDAO, is reviewing a proposal that would see it allocate an additional $750 million of its reserves to U.S. Treasurys.

Top stories in the Crypto Roundup today:

- Voyager Bankruptcy Judge Approves Binance.US $1.3 Billion Deal

- Silvergate Bank in Talks With FDIC to Stay Afloat

- MakerDAO Proposes Allocation of $750 Million to US Treasurys

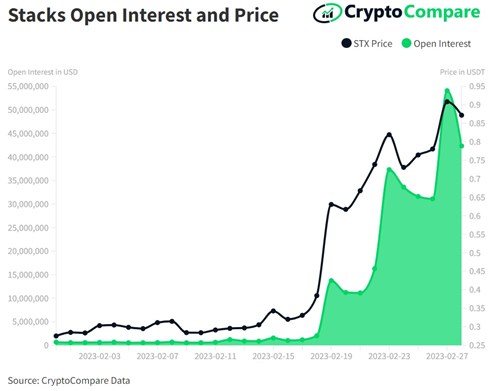

- Stacks’ Open Interest and Price Surge