Seychelles-based cryptocurrency trading platform KuCoin has been hit with a lawsuit filed by New York Attorney General Letitia James, which alleges the exchange violated securities laws.

President Joe Biden's latest budget proposal includes a measure that could see US crypto miners taxed at a rate of 30% on their electricity costs. The tax is meant to reduce mining activity, and would apply to any firm using resources, whether they’re owned or rented.

The US Federal Reserve is reportedly forming a team of experts to monitor developments in the cryptocurrency industry, particularly in relation to unregulated stablecoins. The move is part of the central bank’s effort to maintain oversight of the sector and establish necessary regulations.

Top stories in the Crypto Roundup today:

- New York Regulator Labels Ether a Security in KuCoin Lawsuit

- Biden Admin Budget Proposes 30% Tax on Crypto Mining Energy

- Federal Reserve to Create Crypto-Focused Team

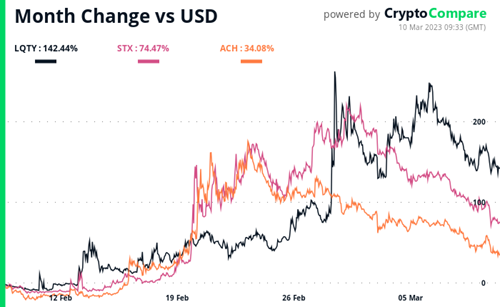

- Crypto Market Movers – LQTY, STX, ACH