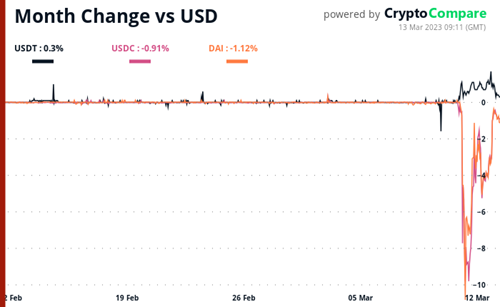

The second-largest stablecoin, USDC, lost its peg to the U.S. dollar over the weekend after it was revealed part of the stablecoins’ reserves were at Silicon Valley Bank. The peg has now nearly been restored after US regulators announced measures to safeguard all depositors at Silicon Valley Bank and Signature Bank after their recent closures.

Decentralized exchanges (DEXs) Uniswap and Curve both recorded lifetime high trading volumes over the weekend as leading stablecoins USDT, USDC, and DAI lost their peg to the US dollar, with the former going above $1, and the other two going below it.

Leading cryptocurrency trading platform Binance has said it converted $1 billion worth of its stablecoin, BinanceUSD (BUSD), into other major digital assets, including BTC, ETH, and BNB to support the market.

Top stories in the Crypto Roundup today:

- USDC Nearly Restores Peg After Treasury Department Says SVB Depositors Will Be Made Whole

- DEXs See Record High Trading Volumes as Stablecoins Depeg

- Binance Converts $1 Billion of BUSD into BTC, ETH, BNB, and Others

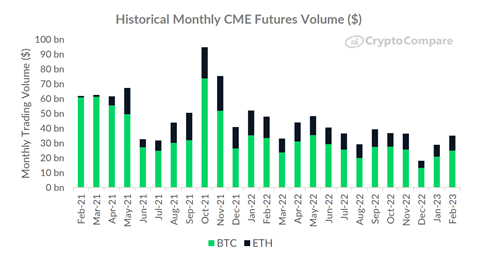

- CME Futures Volumes Rise 21.2% Month on Month