Ethereum’s highly anticipated Shanghai upgrade is one step closer to being activated on the network’s mainnet, following a final dress rehearsal that was carried out on the Goerli testnet, which involved a simulation of staked Ether (ETH) withdrawals.

The U.S. government has requested that Binance.US’s $1 billion deal to buy the assets of bankrupt cryptocurrency lender, Voyager Digital, be put on hold due to legal objections, as per a filing submitted on Tuesday

Over $2.2 billion worth of USD Coin (USDC) was burnt since the start of this week as redemptions crossed $4 billion on Tuesday night, causing waves in the world of cryptocurrency.

Top stories in the Crypto Roundup today:

- Staked ETH Withdrawals Simulated on Final Testnet

- US Government Says Voyager-Binance.US Deal Should be Halted

- $2.2 Billion in USDC Were Burnt in a Single Day

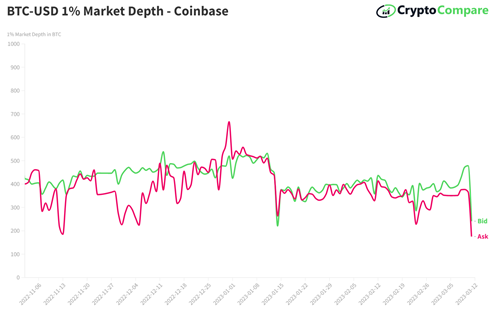

- Exchange Liquidity Witnesses Sharp Fall for USDC Pairs