Microsoft is reportedly working on a built-in Ethereum cryptocurrency wallet for its Edge browser, which would enable its users to send and receive cryptocurrencies and non-fungible tokens (NFTs) without using additional extensions.

The Federal Deposit Insurance Corporation (FDIC) is selling Signature Bank’s deposits and loans to Flagstar Bank, a subsidiary of New York Community Bancorp. Cryptocurrency-related deposits, however, aren’t a part of the deal.

Nasdaq-listed cryptocurrency exchange Coinbase is exploring the launch of an offshore cryptocurrency exchange that would offer perpetual swaps tied to digital assets.

Top stories in the Crypto Roundup today:

- Microsoft Tests Ethereum Wallet in Edge Browser

- FDIC Sells Non-Crypto Signature Bank Deposits

- Coinbase Explores Launching Offshore Derivatives Exchange

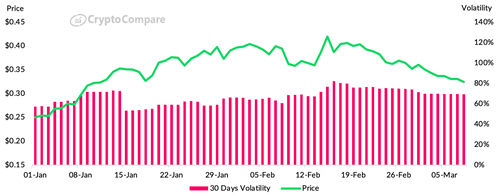

- Cardano’s ADA Struggles to Maintain Momentum