Nasdaq-listed cryptocurrency exchange Coinbase has told clients it will no longer support the real-time payments network of Signature Bank, Signet. Coinbase users who took advantage of the network for U.S. dollar deposits and withdrawals will now be unable to send funds outside normal banking hours.

Florida Governor and potential Republican presidential candidate Ron DeSantis has proposed legislation prohibiting the use of a central bank digital currency (CBDC) as money within the state.

FTX Group has requested intervention from US Bankruptcy Judge John Dorsey to safeguard its assets from liquidators handling the winding down of its Bahamas unit.

Top stories in the Crypto Roundup today:

- Coinbase Drops Support for Signature Bank’s Signet Network

- Florida Governor Calls for CBDC Ban

- FTX Asks Judge to Shield Property From Liquidators

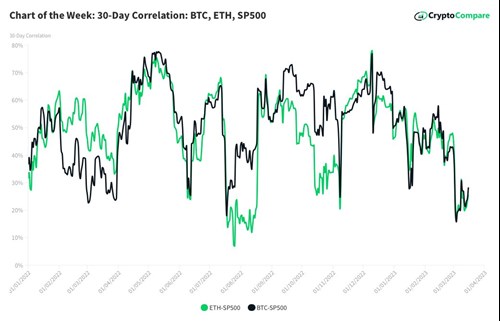

- Chart of the Week: 30-day Correlation: BTC, ETH, S&P 500