Magic Eden, a marketplace for Polygon, Ethereum and Solana-based non-fungible tokens (NFTs), has announced the launch of its own “fully audited” Bitcoin Ordinals marketplace. The platform lets NFT traders buy and sell Ordinals collections.

A recently published report from the White House criticizes digital assets for failing to deliver on their initial promises and raising risks for consumers and the US financial system.

Popular multi-chain decentralized exchange SushiSwap has disclosed that it received a subpoena from the US Securities and Exchange Commission (SEC), indicating that regulatory enforcement action may be forthcoming.

Top stories in the Crypto Roundup today:

- Bitcoin NFTs Get New Marketplace

- White House Takes Aim at Digital Assets in New Report

- Decentralized Exchange SushiSwap Subpoenaed by SEC

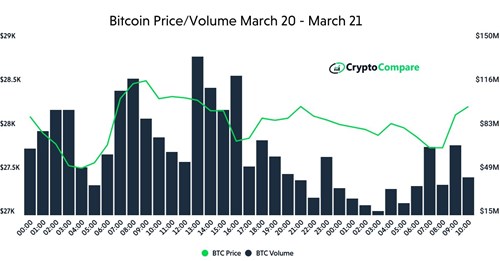

- Bitcoin’s Impressive Rise Year-To-Date