Collapsed cryptocurrency exchange FTX has seemingly secured $500 million to help refund creditors, after selling assets it had invested in.

The founder of Terraform Labs, Do Kwon, has reportedly been arrested in Montenegro, and is now facing fraud charges by US prosecutors in New York.

The decentralized autonomous organization (DAO) behind the popular cryptocurrency-backed stablecoin DAI, MakerDAO, has voted to maintain USDC as its primary reserve asset, even after the cryptocurrency lost its peg amid the US banking crisis.

Top stories in the Crypto Roundup today:

- FTX Gets $500 Million for Refunds

- Terra founder Do Kwon Faces Fraud Charges After Being Arrested

- DAI Issuer MakerDAO Votes to Maintain USDC as Primary Reserve

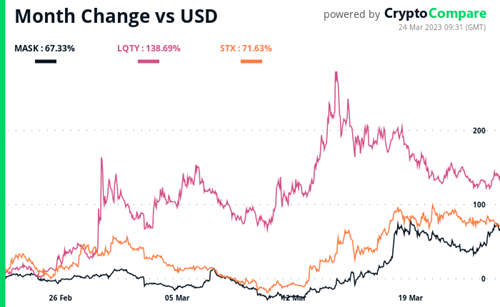

- Crypto Market Movers – LQTY, STX, MASK