Nasdaq-listed cryptocurrency exchange Coinbase has revealed in its Q1 2023 shareholder letter its dedication to modernizing the financial system. The firm reported net revenue growth of 22% in the first quarter and a 24% decrease in total operating expenses.

Fintech firm Block, headed by former Twitter CEO Jack Dorsey, has reported a $2.116 billion Bitcoin revenue from its flagship product, the Cash app, in the first quarter of the year. The firm’s BTC revenue was up 18% from $1.83 billion in Q4 2022.

Bitcoin’s dominance, which measures the cryptocurrency’s share in the broader market, has experienced a sharp increase amid the ongoing instability in the U.S. banking sector. Since early March, the dominance rate has surged from 42% to nearly 49%, a 22-month high.

Top stories in the Crypto Roundup today:

- Coinbase Shrinks Losses and Boosts Revenue in Q1

- Block Reports $2.1 Billion Bitcoin Revenue from Cash App in First Quarter

- Bitcoin Dominance Hits 22-Month High Amid U.S. Banking Crisis

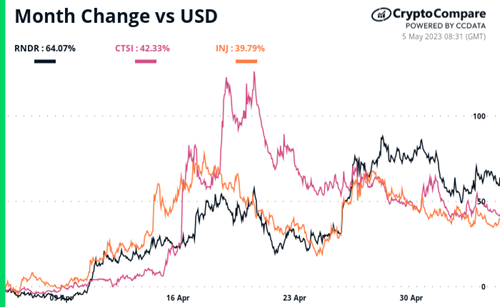

- Crypto Market Movers – RNDR, CTSI, INJ