Leading cryptocurrency exchange Binance has announced that it has decided to halt operations in Canada, citing an evolving and increasingly challenging legal environment as the reason behind its move.

Rune Christensen, the founder of decentralized finance (DeFi) lending platform MakerDAO, has revealed plans to introduce a new stablecoin and governance token, marking the latest development in the platform's strategic overhaul.

The Ethereum network suffered another technical glitch on Friday, which disrupted transaction finality for approximately an hour. This issue, occurring less than a day after a similar disruption, has reignited debates about the stability of the network.

Top stories in the Crypto Roundup today:

- Binance Exits Canada Amid New Crypto Regulations

- MakerDAO Founder Proposes Upgraded Versions of DAI and Governance Token

- Ethereum Network Suffers Second Glitch in Less Than 24 Hours

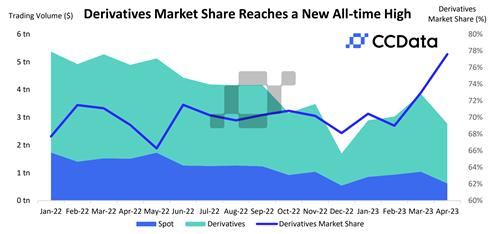

- Derivatives Market Share Reaches New All-time High