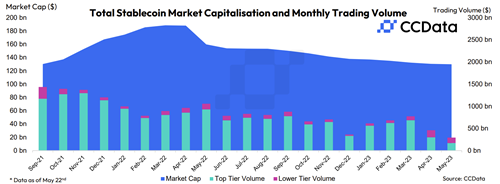

The total market capitalization of stablecoins fell 0.45% to $130 billion as of May 23, the lowest stablecoins market cap since September 2021 and the fourteenth consecutive month of decline.

In a reversal of a previous ruling, a court in Montenegro has ruled that Do Kwon, co-founder of Terraform Labs and former crypto mogul, is to remain in custody.

Fintech firm Ripple has acquired a minority stake in cryptocurrency exchange Bitstamp. This acquisition was overseen by digital investment firm Galaxy Digital, as revealed in a shareholder conference call with the firm.

Top stories in the Crypto Roundup today:

- Stablecoin Market Shrinks for 14th Month in a Row

- Bail Revoked for Terraform Labs Co-Founder Do Kwon in Montenegro

- Ripple Snaps Up Minority Stake in Crypto Exchange Bitstamp

- CCData Announces Addition of L2 Order Book Data to Refinitiv's Data Platforms

According to CCData’s latest

According to CCData’s latest