Stablecoin issuer Circle has expanded its digital Euro Coin (EUROC) to the Avalanche network, making it the second blockchain platform to support the euro-backed stablecoin after it launched on Ethereum last year.

Prominent non-fungible token (NFT) market Binance NFT has announced the launch of a new feature enabling holders to secure Ethereum (ETH) loans using their NFTs as collateral, called Binance NFT loan.

Digital Currency Group’s (DCG) prime brokerage subsidiary, TradeBlock, is set to initiate the formal process of terminating its operations, a direct result of the ongoing economic conditions and a less-than-favorable regulatory climate for cryptocurrency in the United States, as of May 31.

Top stories in the Crypto Roundup today:

- Circle Brings Euro Stablecoin to Avalanche Network

- Binance NFT Launches Loan Service with NFT Collateral

- Digital Currency Group’s Institutional Trading Unit Becomes Latest Crypto Winter Casualty

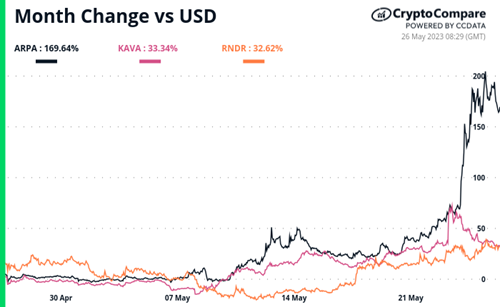

- Crypto Market Movers – RNDR, ARPA, KAVA