Singapore’s sovereign wealth fund Temasek Holdings has openly expressed regret for its ill-judged $275 million investment in the now-defunct cryptocurrency exchange FTX, following the revelation of the deceitful practices that were being hidden from the exchange’s investors.

Non-fungible token marketplace giant Blur launched a peer-to-peer lending and borrowing platform called Blend earlier this month. It has now close to 16,000 loans, aggregating to an impressive sum of 123,500 ETH, or roughly $225 million.

The anonymous entity who seized control over the Tornado Cash decentralized autonomous organization (DAO) via a major governance attack has approved a proposal to reinstate the original state of governance and reduce their share of governance tokens to zero.

Top stories in the Crypto Roundup today:

- Temasek Puts Crypto Investments on Hold After FTX Debacle

- Blur’s NFT Lender Blend Attracts 16,000 Loans Worth $225M in Under a Month

- Tornado Cash Attacker Gives Up Control and Votes to Undo Damage

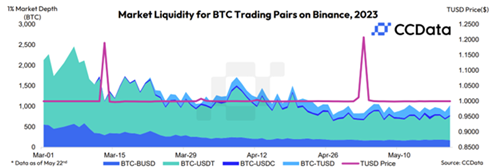

- TUSD Becomes Second Largest Stablecoin by Trading Volume