The popular commission-free trading platform Robinhood (NASDAQ: HOOD) is preparing to launch its crypto trading services in the EU and its brokerage operations in the U.K. in the next few weeks.

Caitlin Long’s cryptocurrency-friendly bank Custodia Bank has launched a Bitcoin custody service targeting entities such as corporate treasurers, fiduciaries, investment advisers, and fund managers.

Stablecoin issuer Circle, the firm behind USDC, is reportedly considering going public in early 2024 as according to sources familiar with the situation it’s in discussions with advisers to prepare for a potential initial public offering (IPO).

Top stories in the Crypto Roundup today:

- Robinhood to Launch Crypto Trading in EU and Brokerage in UK

- Custodia Bank Launches Bitcoin Custody Service

- Stablecoin Issuer Circle Eyes IPO in early 2024

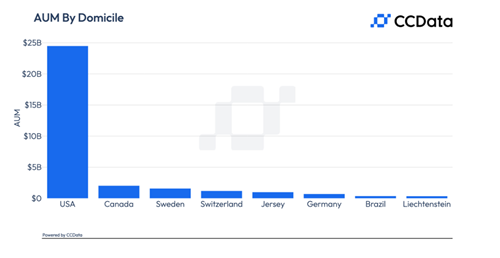

- US Leads Global Digital Asset AUM With $24.5 Billion, Followed by Canada