The U.S. Securities and Exchange Commission (SEC) could greenlight all 12 pending Bitcoin spot exchange-traded fund (ETF) applications within the next eight-day period, as there’s a window for the SEC to approve these filings in that period.

HSBC, one of the world’s largest banks, is set to launch a custody service for tokenized real world assets such as securities, in a service that is aimed at institutional clients who want to securely store digital assets.

A new provision in the U.S. House of Representatives’ spending bill for next year would cut off funds for the SEC to pursue legal actions against crypto businesses. The provision was introduced by Majority Whip Tom Emmer (R-Minn.), a strong supporter of the crypto industry in Congress.

Top stories in the Crypto Roundup today:

- SEC Could Approve Dozen Bitcoin ETFs Over Next Few Days

- HSBC to Launch Custody Service for Tokenized Securities

- House Bill Aims to Stop SEC from Suing Crypto Businesses

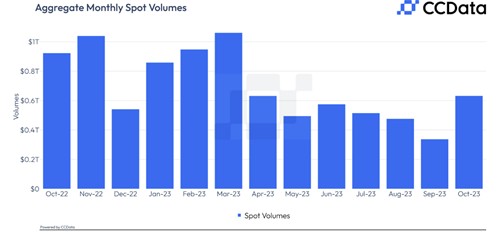

- Spot Trading on Centralized Exchanges Hits Seven Month High in October