Global banking giant JPMorgan has launched a new programmable payment option for its institutional clients using its proprietary blockchain platform JPM Coin. The feature, first shared by Naveen Mallela, who leads JPMorgan's blockchain initiative Onyx, is available to all its institutional clients.

Well-established centralized cryptocurrency exchange Poloniex has suffered a security breach that saw hackers steal around $114 million from its hot wallets. On-chain data showed that various wallets across multiple blockchains were affected.

Ripple’s Chief Executive Officer Brad Garlinghouse has said that he believes the U.S. Securities and Exchange Commission (SEC) has lost sight of their mission to protect investors,” and questioned who the regulator is protecting.

Top stories in the Crypto Roundup today:

- JPMorgan Launches Programmable Payments on JPM Coin

- Poloniex Loses $114 Million in Hot Wallet Hack

- Ripple CEO Brad Garlinghouse Slams SEC for Losing Sight of Investor Protection

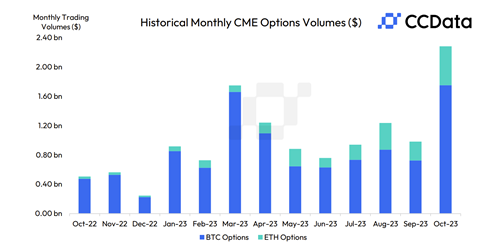

- CME Options Volumes Reach New Highs As Institutional Interest Soars