The cryptocurrency arm of the Chicago Board Options Exchange, Cboe Digital, is set to launch margined Bitcoin and Ether futures contracts on January 11, after receiving approval from the Commodity Futures Trading Commission (CFTC) in June.

A document that appeared to show BlackRock was launching a fund based on XRP, a supposed “iShares XRP Trust,” was posted on the official website of Delaware, where many investment trusts are incorporated, leading to a brief rally for the token.

Crypto.com's Dubai branch has received a Virtual Assets Service Provider (VASP) license, subject to operational approval, from Dubai's regulatory authorities.

Top stories in the Crypto Roundup today:

- Cboe Digital to Launch Margined Bitcoin and Ether Futures

- Fake XRP ETF Filing on Delaware Website Triggers Brief Trading Frenzy

- Crypto.com Receives Crypto License in Dubai

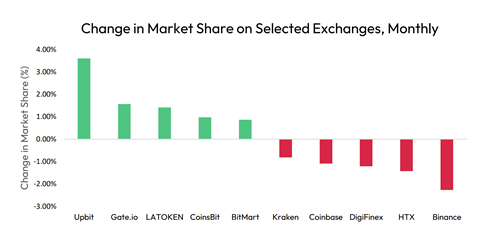

- Upbit Market Share Reaches All-time High as Trading Volumes Surge