Cryptocurrency infrastructure firm Paxos has obtained preliminary approval from the regulator of Singapore for a new entity that aims to launch a stablecoin backed by the U.S. dollar.

Cryptocurrency exchange giant OKX has started providing derivatives trading without the counterparty risk of holding assets on an exchange, building on an existing partnership with asset manager CoinShares and custody joint venture Komainu.

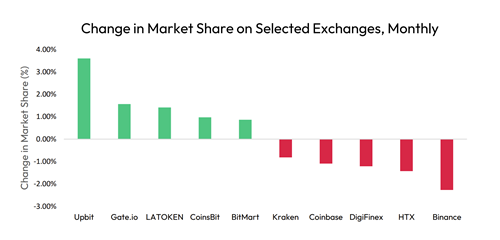

The digital asset market volume has seen a remarkable increase in the past two months, with a major factor behind this surge being the trading activity in Asia, especially South Korea.

Top stories in the Crypto Roundup today:

- Paxos Gets Initial Regulatory Nod to Launch USD-Backed Stablecoin in Singapore

- Crypto Trading Giant OKX Launches Off-Exchange Derivatives Trading

- Crypto Market Volume Soars Amid South Korean Trading Frenzy

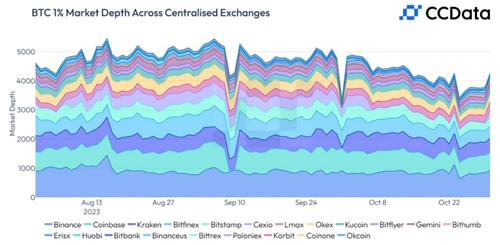

- BTC Pairs Lose Liquidity as Market Depth Drops in October