The U.S. Securities and Exchange Commission (SEC) has filed a lawsuit accusing San Francisco-based cryptocurrency exchange Kraken of breaking federal securities laws by operating without proper registration as a broker, clearing agency and dealer.

Leading cryptocurrency exchange Binance is facing a potential $4 billion fine from the U.S. Department of Justice as part of a deal to end a years-long probe into the trading platform.

Liechtenstein-based cryptocurrency trading platform Bittrex Global has announced it will shut down its operations and end all trading on its platform by December 4 in the wake of several regulatory hurdles that made it harder to run its business.

Top stories in the Crypto Roundup today:

- SEC Charges Kraken with Securities Law Violations and Commingling Customer Funds

- Binance Faces $4 Billion Fine in U.S. to End Criminal Case

- Crypto Exchange Bittrex Global Shuts Down After SEC Settlement

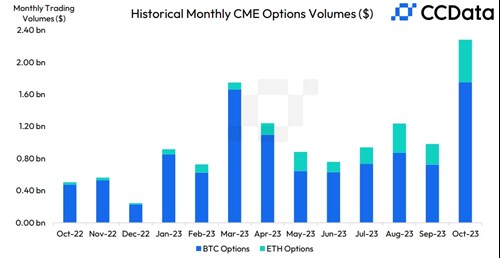

- CME Options Volume Skyrockets in October as Crypto Volatility Returns