Leading cryptocurrency exchange Binance has agreed to pay one of the largest corporate penalties in U.S. history after a coalition of federal regulators accused the exchange of breaking sanctions and money-transmitting laws.

Binance’s founder Changpeng Zhao is set to pay a $175 million release bond and has agreed to return to the United States two weeks before his sentencing on February 24.

Cathie Wood’s ARK Invest in partnership with digital asset firm 21Shares, has made a significant move in the U.S. spot Bitcoin exchange-traded fund (ETF) market by announcing a management fee for their proposed ETF.

Top stories in the Crypto Roundup today:

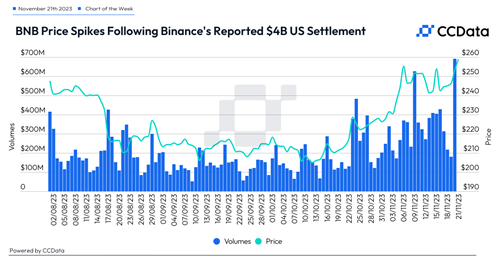

- Binance Settles With U.S. Regulators for $4.3 Billion, CZ Steps Down as CEO

- Binance Founder CZ Released on $175 Million Bond

- Ark and 21Shares Set Fee for Proposed Spot Bitcoin ETF

- BNB’s Price Surges on Binance’s $4 Billion Settlement