Nasdaq-listed cryptocurrency exchange Coinbase has argued that a recent proposal from the U.S. Internal Revenue Service (IRS) could pose a risk to the cryptocurrency sector and the privacy of Americans.

Mastercard has completed a pilot on central bank digital currency (CBDC) with the Reserve Bank of Australia and the Digital Finance Cooperative Research Centre. The initiative probed the mechanisms through which vetted entities, compliant with know-your-customer procedures, could manage, utilize, and redeem CBDCs.

The queue for new validators on the Ethereum blockchain has almost vanished for the first time since the “Shapella” upgrade in April, which completed Ethereum’s transition to a fully-functional Proof-of-Stake network.

Top stories in the Crypto Roundup today:

- Coinbase Challenges IRS Crypto Tax Proposal That Would Impose “Unprecedented” Tracking

- Mastercard Completes CBDC Pilot with Australia’s Central Bank

- Ethereum Validator Queue Hits Record Low as Staking Rewards Fall

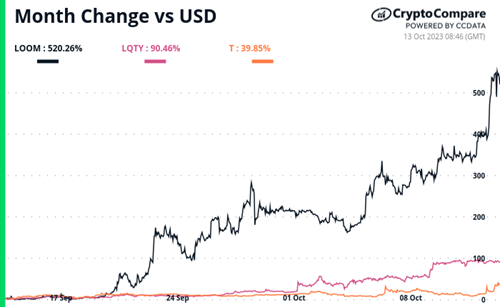

- Crypto Market Movers – LOOM, LQTY, T