Leading cryptocurrency exchange Binance has warned that new upcoming European Union regulations could lead to a wave of stablecoins delistings as legal experts navigate the implications of the EU’s Markets in Crypto Assets (MiCA) legislation.

The United Kingdom’s financial markets regulator, the Financial Conduct Authority (FCA), has said it’s making a final warning to entities promoting cryptocurrency products to British consumers, and noted the consequences of not complying could be severe.

Leading stablecoin issuer Tether has started providing loans denominated in its USDT stablecoin to clients again, nearly a year after announcing it was halting the offering this year. The rise in USDT loans was revealed in the firm’s latest quarterly financial update.

Top stories in the Crypto Roundup today:

- Binance Exec Warns of Potential Stablecoins Delisting in Europe

- FCA Issues ‘Final Warning’ to Crypto Firms Over Upcoming Ad Regulations

- Tether Resumes USDT Loans, Despite Previous Pledge

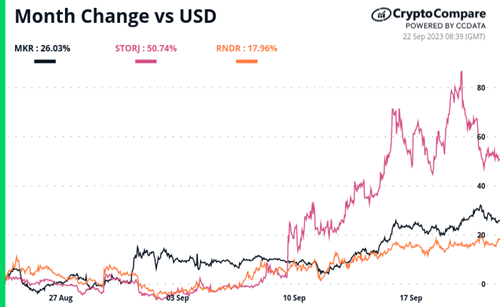

- Crypto Market Movers – MKR, STORJ, RNDR