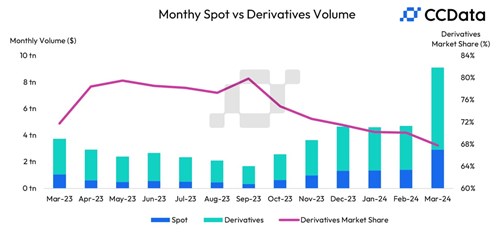

The combined trading volume on centralized cryptocurrency exchanges nearly doubled to a record-breaking $9.1 trillion in March, with spot trading outpacing the growth of derivatives trading.

Fintech firm Ripple is moving into the stablecoin market with the introduction of its own U.S. dollar-backed offering, in a move that positions Ripple as a competitor in a sector that the firm projected could balloon to $2.8 trillion by 2028.

Leading cryptocurrency exchange Binance has announced that it will be winding down support for Bitcoin non-fungible tokens (NFTs in a move that comes just a few months after Binance introduced Bitcoin Ordinals to its platform.

Top stories in the Crypto Roundup today:

- Crypto Trading Volume Hit New $9.1 Trillion All-Time High

- Ripple to Enter Stablecoin Market With U.S. Dollar-Pegged Token

- Binance to Drop Support for Bitcoin NFTs

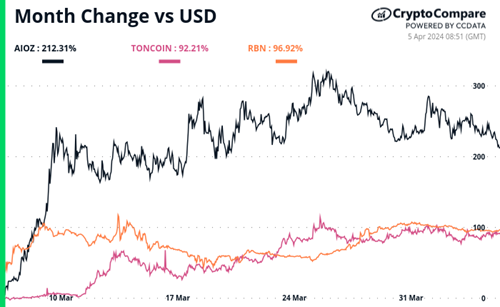

- Crypto Market Movers – AIOZ, TON, RBN