On August 5, the price of BlackRock's spot Bitcoin exchange-traded fund (ETF), the iShares Bitcoin Trust (IBIT), plummeted by 14% at the market opening, following an 8% decline the previous week. Despite the drop, senior Bloomberg ETF analyst Eric Balchunas noted that there were no flows, indicating that traders held their positions firmly.

Anchorage Digital has announced the expansion of its custody services to include tokens on the Solana blockchain to meet the evolving needs of its diverse clientele, which includes venture capital firms, hedge funds, and protocol treasuries.

On August 6, Marathon Digital Holdings (NASDAQ: MARA) released its unaudited Bitcoin production and miner installation updates for July 2024. The company reported notable increases in both Bitcoin production and operational efficiencies, highlighting its commitment to maintaining a leading position in the Bitcoin mining industry.

Top stories in the Crypto Roundup today:

- BlackRock’s Spot Bitcoin ETF Sees Zero Outflows Amid Price Drop

- Anchorage Digital Expands Custody Support to Solana Tokens

- Marathon Digital Boosts Bitcoin Production and Hash Rate in July 2024

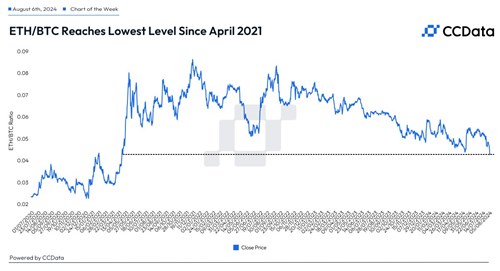

- Chart of the Week: ETH/BTC Reaches Lowest Level Since April 2021