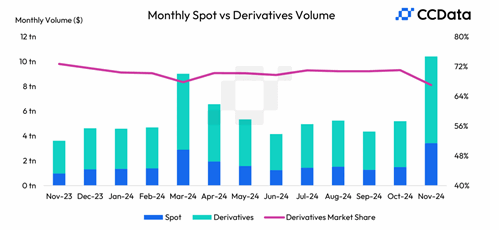

The trading volume on centralized cryptocurrency exchanges hit a new all-time high in November, surpassing $10 trillion after both spot and derivatives volumes surged 101%.

The Chair of the Federal Reserve, Jerome Powell, has likened the flagship cryptocurrency Bitcoin to gold, saying it’s used as a speculative asset “just like gold only it’s virtual.

The United States Commodity Futures Trading Commission (CFTC) announced it secured a record $17.1 billion in monetary relief during the 2024 fiscal year, with a significant portion of the funds coming from enforcement actions involving the cryptocurrency industry.

Top stories in the Crypto Roundup today:

- Cryptocurrency Trading Volume Soar to Record $10 Trillion in November

- Fed Chair Jerome Powell Says Bitcoin is ‘Just Like Gold Only It’s Virtual’

- CFTC Secures Record $17.1 Billion in Enforcement Actions

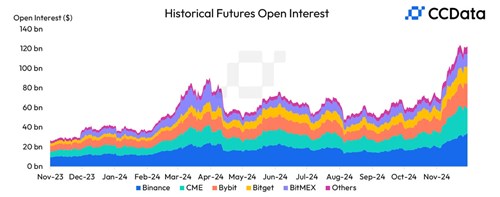

- Crypto Open Interest Hit Record Highs in November