Grayscale's Bitcoin Trust (GBTC), the world's largest publicly traded Bitcoin investment vehicle, has shown signs of stabilization after experiencing significant outflows in recent months.

Carson Group, a registered investment advisory firm with $30 billion in assets under management, has announced its approval of only four out of the ten newly launched spot Bitcoin ETFs.

U.S. forex giant OANDA is entering the UK's cryptocurrency trading scene with the launch of OANDA Crypto, a London-based platform registered with the Financial Conduct Authority (FCA).

Top stories in the Crypto Roundup today:

- GBTC Outflows Reach Lowest Level Since ETF Conversion

- $30 Billion Investment Advisory Firm Selects Just Four Spot Bitcoin ETFs For Its Offerings

- Forex Giant OANDA Enters UK Crypto Market with FCA-Registered Platform

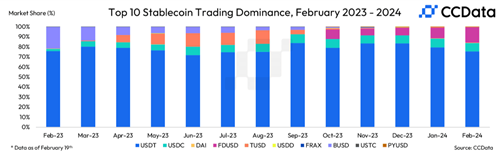

- FDUSD Market Share Rises Following Surge in BTC Trading Volumes