|

Cathie Wood’s ARK Investment Management, together with the U.S. brranch of crypto exchange-traded product issuer 21Shares, has filed a registration notice for the ARK 21Shares Bitcoin ETF with the U.S. Securities and Exchange Commission (SEC).

A group of former Citigroup executives is planning on launching a new venture to offer Bitcoin-backed securities, which, they claim, do not require approval from the U.S. Securities and Exchange Commission (SEC).

Leading cryptocurrency exchange Binance has recently added a “monitoring tag” to a number of cryptocurrencies, including privacy-focused digital assets Monero (XMR), Zcash (ZEC), Horizen (ZEN), and Firo (FIRO).

Top stories in the Crypto Roundup today:

- Grayscale and VanEck Join ARK 21Shares in Submitting Bitcoin ETF Filings

- Former Citi Execs to Offer Bitcoin Securities Exempt From SEC Registration

- Binance Puts Privacy Coins Under Scrutiny with Monitoring Tag

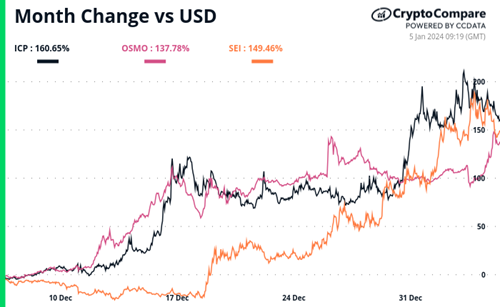

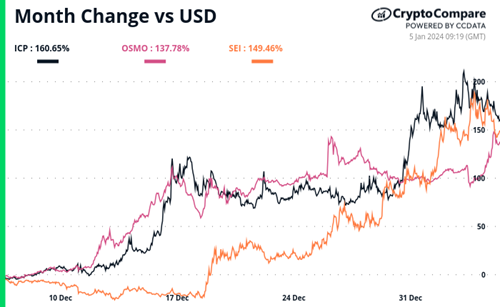

- Crypto Market Movers – ICP, OSMO, SEI

|

|

Grayscale and VanEck Join ARK 21Shares in Submitting Bitcoin ETF Filings

|

Cathie Wood’s ARK Investment Management, together with the U.S. brranch of crypto exchange-traded product issuer 21Shares, has filed a registration notice for the ARK 21Shares Bitcoin ETF with the U.S. Securities and Exchange Commission (SEC).

Using Form 8-A, the company registered its securities on the Cboe BZX Exchange on January 4. That day, two bitcoin trusts – that of VanEck and Grayscale - also registered their securities on the same exchange, as well as the NYSE Arca, respectively, with the same form.

On January 3, Fidelity’s spot Bitcoin ETF got approval for listing on the Cboe BZX Exchange. The SEC now has until January 10 to decide whether it will approve or reject the ARK 21Shares Bitcoin ETF. Last year, the regulator turned down the ARK 21Shares Bitcoin ETF on Cboe BZX on Jan. 26, 2023, citing inadequate safeguards against fraud and manipulation

The ARK 21Shares Bitcoin ETF will charge a yearly fee of 0.80% for costs like listing and marketing, if the SEC approves it.

|

Former Citi Execs to Offer Bitcoin Securities Exempt From SEC Registration

|

A group of former Citigroup executives is planning on launching a new venture to offer Bitcoin-backed securities, which, they claim, do not require approval from the U.S. Securities and Exchange Commission (SEC).

The new venture, called Receipts Depositary Corp. (RDC), is set to offer securities called “BTC DRs” which are similar to American depositary receipts for foreign stocks and will be accessible to institutional investors through the Depository Trust Company.

RDC's Bitcoin depositary receipts will be available for transactions exempt from the 1933 Securities Act's registration requirements as it aims to cater to institutional investors’ interest in the cryptocurrency space.

While the market is widely expecting a spot Bitcoin exchange-traded fund to soon be approved in the country to meet such demand, BTC DRs would differ by offering direct BTC ownership while shares in Bitcoin ETFs would be redeemed for cash.

|

Binance Puts Privacy Coins Under Scrutiny with Monitoring Tag

|

Leading cryptocurrency exchange Binance has recently added a “monitoring tag” to a number of cryptocurrencies, including privacy-focused digital assets Monero (XMR), Zcash (ZEC), Horizen (ZEN), and Firo (FIRO).

According to the exchange, tokens with the monitoring tag “exhibit notably higher volatility and risks compared to other listed tokens,” and are at risk of being delisted from its platform.

The exchange will regularly review these tagged tokens, evaluating factors such as trading volume, liquidity, network stability, security, and their contribution to a robust and sustainable cryptocurrency ecosystem, it said.

Users interested in trading these tagged tokens must complete a quiz to confirm their understanding of the associated risks, as per Binance's announcement.

|

Crypto Market Movers – ICP, OSMO, SEI

|

Several tokens are leading the charge in the last 7-day period. Some of these are well-known cryptocurrencies with more liquid trading pairs, so we’ll be focusing on these over low-cap cryptos that may have higher percentage changes.

Internet Computer (ICP) - The Internet Computer (ICP) token is a native token that is used to power the Internet Computer protocol. The ICP token is an essential part of the Internet Computer protocol as it serves as the underlying fuel for the protocol’s network and incentivizes participants to build and maintain the network.

Osmosis (OSMO) - The Osmosis ecosystem encompasses a suite of premier, DAO-gated dApps that are seamlessly integrated into the Osmosis AMMs and IBC routing capabilities. Its continuous expansion offers new apps and features, aiming to become a full-service, cross-chain exchange and DeFi hub that balances the user experience of centralized exchanges without compromising the benefits of decentralized finance.

Sei (SEI) - Sei is an open-source, permissionless Layer 1 blockchain, crafted specifically to redefine digital asset exchanges. Optimized for speed, Sei leverages its unique Twin-Turbo Consensus mechanism to ensure rapid transactions. Designed to fulfill the demands of a Web3 environment, Sei offers features like frontrunning protection, efficient block propagation, and instant finality, making it an ideal platform for applications requiring high-performance and top-tier user experience.

|

|

|

|

|

State of the Crypto by Top Tier Exchange Volume

|

Build your project with CoinDesk Data

|

|

|

|

Terms

| Privacy

13 Charles II St, SW1Y 4QU

London, UK

This email may include advertisements by third parties. None of the advertised or promoted products and services have been verified or approved by us and this email is not any endorsement by us of the third party or of their products or services.

|

|

|

|

|