In their first day of trading, spot Bitcoin exchange-traded funds (ETFs) in the United States saw $4.6 billion in trading volume as investors took advantage of these products that had so far been rejected by the Securities and Exchange Commission (SEC).

Asset manager Vanguard’s decision to exclude spot Bitcoin ETFs from its platform has led to a shift among some of its customers, who are now threatening to close their accounts over it.

The issuer of the popular USDC stablecoin, Circle Internet Financial, has recently filed to go public after filing a confidential draft S-1 document with the U.S. Securities and Exchange Commission.

Top stories in the Crypto Roundup today:

- Spot Bitcoin ETFs Debut With $4.6 Billion in Trading Volume

- Vanguard Refuses to Offer Bitcoin ETFs, Angering Clients

- USDC Issuer Circle Eyes Initial Public Offering

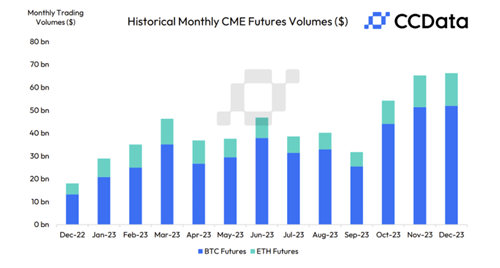

- CME Derivatives Volumes Reach Highest Level Since Nov 2021