The estate of bankrupt cryptocurrency exchange FTX has offloaded the bulk of its holdings in the Grayscale Bitcoin Trust (GBTC) exchange-traded fund. Within just three days of trading Marex Capital Markets, acting on behalf of FTX, sold over two-thirds of FTX's 22.28 million GBTC shares.

Since the launch of spot Bitcoin exchange-traded funds in the United States, leading Bitcoin futures-based fund ProShares Bitcoin Strategy ETF (BITO) has experienced a significant slowdown in activity.

Leading cryptocurrency exchange Binance has faced the U.S. Securities and Exchange Commission (SEC) in court, seeking dismissal of a lawsuit filed by the regulator. The key issue debated was whether certain cryptocurrencies, including BNB and BUSD, traded on Binance are securities under SEC regulations.

Top stories in the Crypto Roundup today:

- FTX’s Estate Sells $600 Million Worth of GBTC Shares

- Futures-Based Bitcoin ETF Struggles After Launch of Spot ETFs

- Binance Fights SEC Lawsuit Over Crypto Securities in Court

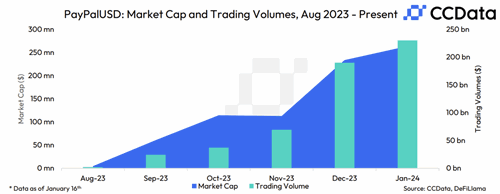

- PayPal's PYUSD Climbs to Top 10 Stablecoins by Market Cap