The spot Bitcoin exchange-traded funds (ETFs) recently launched in the United States have seen combined negative outflows for the first time since their debut on January 11, with withdrawals from Grayscale’s GBTC outpacing inflows.

Ethereum’s Dencun upgrade is set to dramatically reduce transaction costs, according to developers, and the upgrade has now seen them set a timeline for its release according to a recent blog post from the Ethereum Foundation.

After a consultation on a central bank digital currency (CBDC), the UK’s central bank the Bank of England and HM Treasury have revealed their intention to prioritize “privacy and control.”

Top stories in the Crypto Roundup today:

- Bitcoin ETFs See First Net Outflow as GBTC Loses Ground

- Ethereum Developers Set Timeline for Dencun Upgrade

- Bank of England Emphasizes Privacy in Potential CBDC Launch

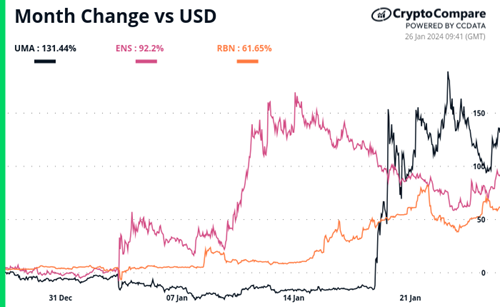

- Crypto Market Movers – UMA, ENS, RBN