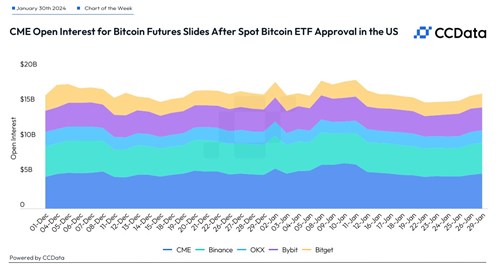

The launch of spot Bitcoin exchange-traded funds (ETFs) has reduced demand for Bitcoin futures, as open interest for the CME Group’s Bitcoin futures has dropped around 24% after the launch of the spot Bitcoin ETFs, as of January 30.

Ethereum’s Dencun upgrade, which is set to help dramatically reduce transaction costs on the network, went live on the Sepolia testnet, as it moves closer to introducing the highly-anticipated “proto-danksharding” feature.

German authorities have, with the support of the U.S. Federal Bureau of Investigation (FBI), seized 50,000 Bitcoin valued at around $2.1 billion in an operation that targeted operators of piracy websites.

Top stories in the Crypto Roundup today:

- Spot Bitcoin ETFs Dampen Demand for BTC Futures

- Ethereum’s Dencun Upgrade Deployed on Sepolia Testnet

- German Authorities Seizes $2.1 Billion in Bitcoin from Piracy Website Operators

- Chart of the Week: Bitcoin Futures Open Interest on CME Slides