Major Indian cryptocurrency exchange WazirX experienced a wallet exploit resulting in the theft of over $230 million in crypto assets. The attack targeted the exchange's multi-sig wallet on the Ethereum network, causing significant market volatility for affected tokens.

Leading cryptocurrency exchange Kraken has announced the expansion of its Kraken Custody services to institutional clients in the United Kingdom and Australia, marking Kraken Custody's first international rollout following its successful launch in the United States earlier this year.

Defunct crypto lender BlockFi has confirmed the commencement of initial cryptocurrency distributions to eligible clients via Coinbase, in a process that starts this month and will be conducted in batches over several months, with clients receiving notifications via their registered email addresses.

Top stories in the Crypto Roundup today:

- India’s WazirX Exchange Hit by Major Security Breach: Over $230 Million in Crypto Stolen

- Kraken Expands Crypto Custody Services to Institutional Clients in the UK and Australia

- BlockFi to Begin Processing Crypto Distributions via Coinbase

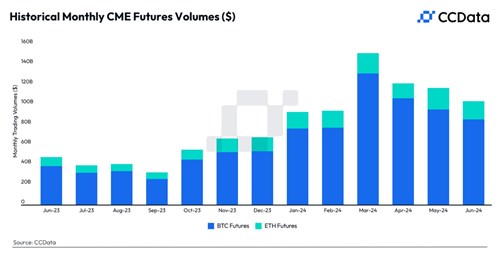

- CME Institutional Volumes Decline After Strong Performance in May