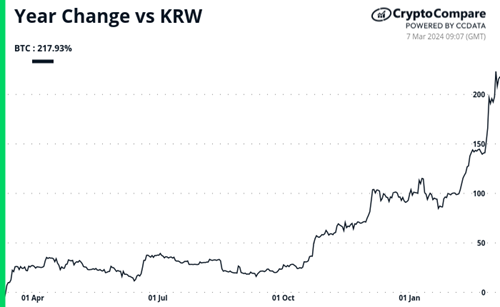

The price of Bitcoin in South Korea surged to a 27-month high on Wednesday, reflecting strong buying pressure from local investors. The premium on Bitcoin traded on South Korean exchanges compared to the global market, known as the "Kimchi Premium," reached 10.32% as a result.

Bankrupt cryptocurrency lender BlockFi has reached an in-principle settlement of $874.5 million with the estates of collapsed crypto exchange FTX and its sister firm Alameda Research.

The British government has launched a consultation seeking public feedback on its plans to implement the Organization for Economic Co-operation and Development's (OECD) new crypto reporting framework.

Top stories in the Crypto Roundup today:

- Bitcoin’s Kimchi Premium Reaches 27-Month High

- BlockFi Reaches $874.5 Million Settlement with FTX and Alameda Research Estates

- UK Seeks Public Input on Crypto Reporting Framework Implementation

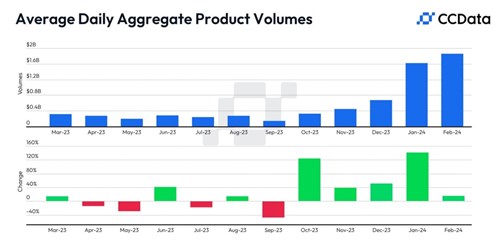

- Digital Asset AUM Rose 27% to $65bn in February