Bitcoin miners are experiencing a windfall, with earnings reaching all-time highs last week as the price of the leading cryptocurrency has risen to a new record above $72,000.

Nasdaq-listed cryptocurrency exchange Coinbase has announced plans to offer $1 billion in convertible senior notes in a bid to settle existing debt and allocate funds for general corporate purposes.

VanEck's spot Bitcoin exchange-traded fund, the VanEck Bitcoin Trust (HODL), is seeing a surge in popularity after slashing its sponsor fees to zero until March 31, 2025, raking in a record $119 million in daily inflows.

Top stories in the Crypto Roundup today:

- Leveraged Bitcoin ETFs Gain Traction

- Coinbase to Offer $1 Billion in Convertible Notes

- VanEck’s Spot Bitcoin ETF Fee Cut Fuels Record $119 Million Inflows

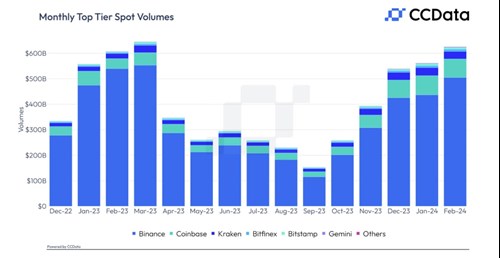

- Binance's Spot Volume Rises to Highest Level Since March 2023 Banking Crisis