China’s top cybersecurity watchdog is accusing the United States of unlawfully seizing over 127,000 bitcoin, now worth around $13 billion, that were allegedly stolen in a 2020 hack targeting a Chinese crypto mining pool.

Coinbase has called off a $2 billion deal to acquire U.K.-based stablecoin startup BVNK, the crypto exchange confirmed. The companies had entered exclusive talks in October but mutually agreed not to proceed.

JPMorgan has launched JPM Coin, a blockchain-based deposit token for institutional clients, enabling near-instant payments via Coinbase’s Base network, Bloomberg reported.

Top stories in the Crypto Roundup today:

- China Accuses U.S. of Seizing $13B in Bitcoin Linked to 2020 Crypto Hack

- Coinbase Ends $2B Deal Talks With Stablecoin Startup BVNK

- JPMorgan Launches Blockchain-Based Deposit Token on Coinbase’s Base Network

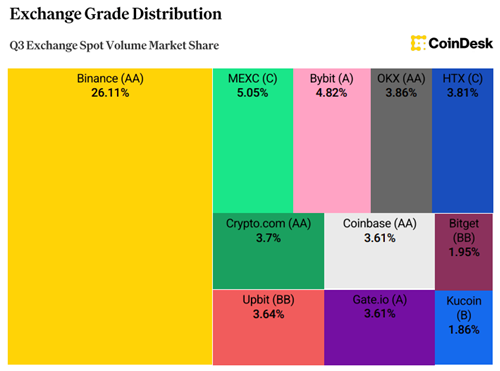

- Binance Tops CoinDesk’s Exchange Rankings, but Market Share Shifts Toward Smaller Venues