Coinbase has moved its state of incorporation from Delaware to Texas, joining a wave of tech firms dissatisfied with Delaware’s legal environment.

Visa is piloting stablecoin payments to crypto wallets, aiming to help gig workers and digital creators in countries with volatile currencies get paid in U.S. dollar-backed tokens.

Circle posted better-than-expected third-quarter results, driven by a sharp rise in USDC transaction volume, prompting investment bank William Blair to reaffirm its “Outperform” rating on the stock.

Top stories in the Crypto Roundup today:

- Coinbase Moves Incorporation to Texas, Joining Exodus From Delaware Led by Musk

- Visa Pilots Stablecoin Payouts for Gig Workers and Creators Worldwide

- Circle's USDC Growth Fuels Bullish Outlook After Strong Q3 Results

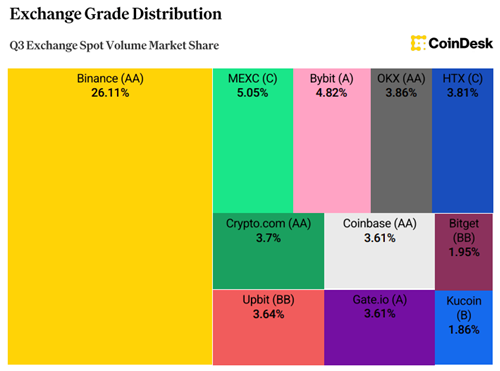

- Binance Tops CoinDesk’s Exchange Rankings, but Market Share Shifts Toward Smaller Venues