Coinbase Prime has added Ethereum as a staking option for U.S. domestic institutional clients, offering a new crypto on-ramp for institutions while allowing them to generate yield by staking their ETH.

Cross-chain token bridge Nomad has seen attackers drain virtually all of its funds, leading to a total loss of near $200 million. Nomad, which like other cross-chain bridges, allows users to send and receive tokens between different blockchains, acknowledged the exploit and said an investigation is ongoing.

The U.S. Securities and Exchange Commission (SEC) has charged 11 people in an alleged $300 million cryptocurrency Ponzi scheme known as Forsage, which raised funds using promoters to convince other investors to recruit others into the scheme.

Top stories in the Crypto Roundup today:

- Coinbase Prime Adds Ethereum Staking for U.S. Institutions

- Cross-chain Bridge Nomad Exploited for $200 Million

- SEC Charges 11 in Alleged $300 Million Crypto Ponzi Scheme

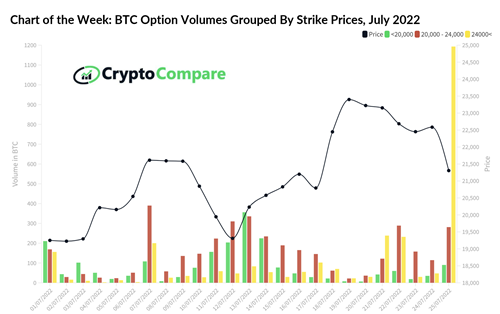

- Chart of the Week: BTC Option Volumes Grouped by Strike Prices