The Ukrainian government has raised over $10 million in cryptocurrency after it started accepting donations in crypto amidst an ongoing war with Russia. According to Ukraine’s official Twitter account, it has been accepting donations in BTC and ETH.

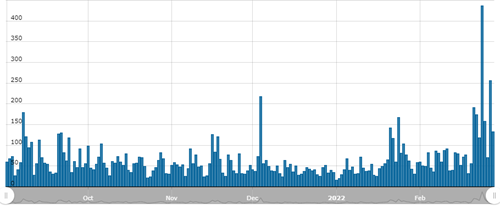

Bitcoin trading volumes denominated in the Russian ruble, the country’s fiat currency, have exploded last week after Russian President Vladimir Putin announced a “special military operation” against Ukraine that has been deemed an invasion.

On-chain data shows that the number of Bitcoin addresses with a non-zero BTC balance has reached a new all-time high above 40 million. Moreover, wallets with a positive Bitcoin balance are holding onto them for longer periods.

CryptoCompare's Digital Asset Summit is returning on 30th March at Old Billingsgate, London. As Europe's flagship institutional summit for digital assets, this is the perfect opportunity to connect with key industry decision-makers and leading names in finance who are adopting and embracing the digital asset revolution.

Top stories in the Crypto Roundup today:

- Ukrainian Government Raises Over $10 Million in Crypto

- Ruble-Denominated Bitcoin Volumes Surge

- Non-Zero Bitcoin Addresses Hit New High

- Understanding Fiat Currencies and Bitcoin’s Supply Limit

- CCDAS Summit - Get 10% Off for Being a Loyal Reader