Goldman Sachs has executed its first over-the-counter crypto options trade, making it the first major U.S. bank to trade cryptocurrencies over the counter. The firm traded a non-deliverable Bitcoin option, a derivative tied to Bitcoin’s price that pays out in cash.

The world’s largest hedge fund, Bridgewater Associates, is reportedly planning to back its first cryptocurrency fund. The fund, with over $150 billion in assets under management, is not planning to directly invest in cryptoassets itself.

Ethereum’s burning mechanism, introduced in the London hard fork through EIP-1559, has so far destroyed over 2 million ETH tokens, worth nearly $6 billion. The mechanism came as part of a restructure to the network’s fee system.

CryptoCompare's Digital Asset Summit is returning on 30th March at Old Billingsgate, London. As Europe's flagship institutional summit for digital assets, this is the perfect opportunity to connect with key industry decision-makers and leading names in finance who are adopting and embracing the digital asset revolution.

Top stories in the Crypto Roundup today:

- Goldman Sachs Conducts OTC Crypto Options Trade

- World’s Largest Hedge Fund to Back Crypto Fund

- 2 Million ETH Has Been Burned Ahead of Ethereum 2.0 Rollout

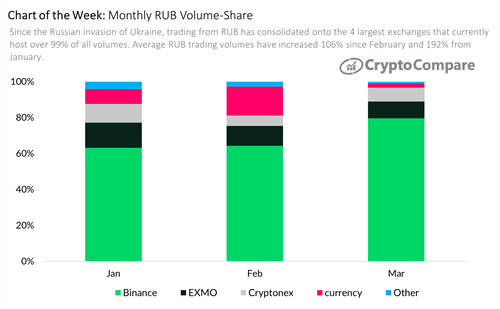

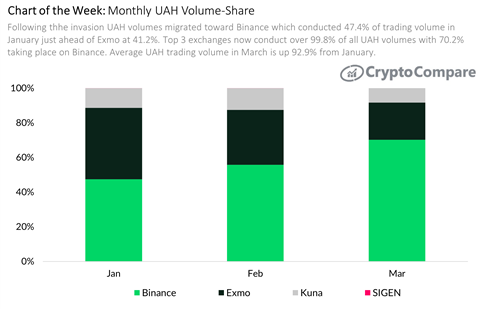

- Chart of the Week: Monthly RUB/UAH Volume-Share

- CCDAS Summit - Get 10% Off for Being a Loyal Reader