JPMorgan is now using blockchain for collateral settlements in its latest experimentation with the technology. On May 20 the bank conducted its first such transaction, with two of its entities transferring tokens representing BlackRock money market fund shares as collateral on its private blockchain.

Popular browser-based wallet MetaMask is set to start helping victims of cryptocurrency scams and phishing attacks recover their lost assets through a new partnership with London-based Asset Reality, a specialist in recovering stolen assets.

Tether, the company behind the world’s largest stablecoin USDT, has announced the launch of MXNT, a stablecoin backed by Mexico’s national currency, the peso. MXNT will initially be available on Ethereum, Tron, and Polygon.

Sponsored: Binance has launched a special promotion for new Binance Card users!

Top stories in the Crypto Roundup today:

- JPMorgan is Using Blockchain for Collateral Settlements

- MetaMask to Support Crypto Scam Victims Through New Partnership

- Tether Launches Mexican Peso-Backed Stablecoin

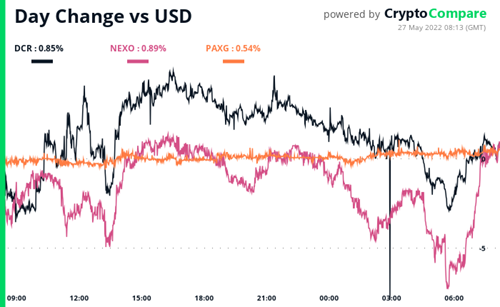

- Crypto Market Movers – DCR, NEXO, PAXG

- Sponsored: Get 5 BUSD & Stand a Chance to Win 1 Bitcoin in Token Voucher with Binance Card!