Cryptocurrency lender BlockFi has filed for bankruptcy in the US, citing “significant exposure” to the collapse of cryptocurrency exchange FTX. BlockFi had already halted most activity on its platform and is seeking court protection to restructure, settle its debts, and recover money for investors.

The MakerDAO community has rejected a proposal to use up to $500 million of the stablecoin USDC to invest in a portfolio of corporate debt securities and government-backed bonds, aiming to return a yield matching the Secured Finance Rate (SOFR), which currently stands at 3.8%.

Fidelity has opened up retail cryptocurrency trading accounts after announcing a waiting list for them earlier this month. The investment powerhouse sent an email to users detailing that a Fidelity brokerage account is needed to be able to fund a new Fidelity Crypto account.

Top stories in the Crypto Roundup today:

- BlockFi Files for Bankruptcy

- MakerDAO Rejects Proposal to Invest $500 Million in Bonds

- Fidelity Opens Retail Crypto Accounts

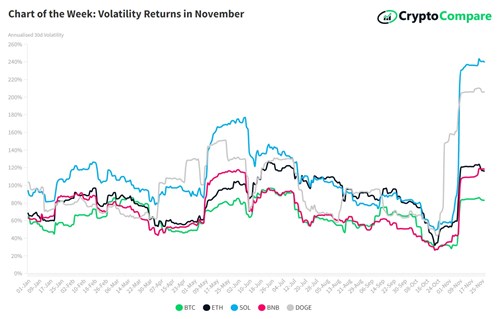

- Chart of the Week: Volatility Returns in November