Coinbase co-founder, and CEO Brian Armstrong has expressed worries over rumors of the U.S. Securities and Exchange Commission (SEC) considering a ban on cryptocurrency staking for retail investors.

Popular cryptocurrency exchange Kraken is reportedly embroiled in a probe from the U.S. Securities and Exchange Commission (SEC) over whether the firm broke securities laws related to certain offerings to American clients.

Deutsche Bank’s asset management arm DWS Group, led by CEO Stefan Hoops, is in talks to invest in two German cryptocurrency firms as part of the company’s efforts to revive growth. The bank is looking to buy a minority stake in Deutsche Digital Assets and Tradias.

Sponsored: B2Broker, a provider of white-label liquidity for FX and crypto markets, has expanded its globally recognized white-label liquidity products for digital businesses. By integrating Match-Trader into its white-label solution, B2Broker has demonstrated its commitment to providing customers with the most comprehensive and versatile solution on the market.

Top stories in the Crypto Roundup today:

- Coinbase CEO Cites Rumors of US Crypto Staking Ban

- Kraken Faces SEC Probe Over Unregistered Securities

- Deutsche Bank’s DWS in Talks to Invest in Two Crypto firms

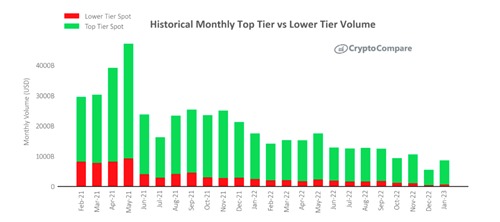

- Spot Trading Volumes Saw the Largest Percentage Increase Since January 2021

- Sponsored: B2Broker and Match Trader Announce Powerful Integration for New White Label Model