Ethereum developers have moved the network one step closer to enabling withdrawals of the $26 billion of staked Ethereum currently helping validate transactions, after successfully deploying the first mainnet shadow fork for the Shanghai upgrade.

Popular decentralized finance (DeFi) protocol MakerDAO has seen its community approve a proposal to deploy up to $100 million in USDC from its reserve to Yearn Finance, where the stablecoin will be used to earn yield.

The CEO of Grayscale Investments, Michael Sonnenshein, has said that he believes the approach to regulatory enforcement by the United States Securities and Exchange Commission (SEC) has been slowing down Bitcoin’s progress.

Top stories in the Crypto Roundup today:

- Ethereum Developers Staked ETH Withdrawals Closer to Reality

- MakerDAO to Deploy $100M USDC on Yearn Finance

- SEC’s ‘One-Dimensional Approach’ is Slowing Bitcoin’s Progress, Says Grayscale CEO

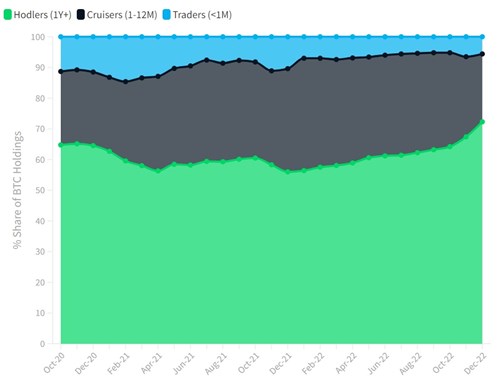

- Percentage of Long-Term BTC Holders Hits New High