The U.S. Securities and Exchange Commission (SEC) has given the green light to the first leveraged Bitcoin futures exchange-traded fund (ETF) on Friday. The Volatility Shares 2x Bitcoin Strategy ETF (BITX) is poised to make its debut on the Chicago Board Options (CBOE) BZX Exchange on June 27.

The ProShares Bitcoin Strategy ETF (BITO), a Bitcoin futures fund, has seen a dramatic uptick in capital inflows on June 26, seeing the most significant weekly inflow in a year at $65.3 million, pushing its assets above $1 billion.

The Financial Action Task Force (FATF) has urged nations worldwide to enforce the "Travel Rule” to combat money laundering and terrorism financing with the use of cryptocurrencies.

Top stories in the Crypto Roundup today:

- SEC Approves First Leveraged Bitcoin Futures ETF

- BITO Sees Record Yearly Inflows of $65.3 Million in a Week

- FATF Urges Nations to Enforce Crypto Travel Rule

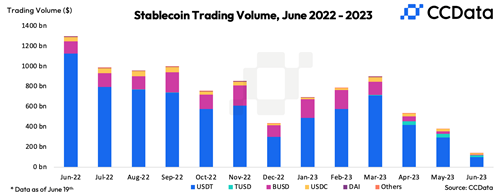

- Stablecoin Trading Volume Drops to New Yearly Lows