Popular cryptocurrency Exchange Kraken has announced it plans to launch its own bank “very soon,” despite the current challenging regulatory environment and recent enforcement actions in the space.

The US Securities and Exchange Commission (SEC) has taken action against BKCoin and its former chief investment officer, Timothy T. Kang, following allegations of misappropriation of funds.

BinanceUSD (BUSD), the stablecoin issued by Paxos for the leading cryptocurrency exchange, has seen its market capitalization plunge over the last 30 days as investors move away from the cryptocurrency.

Top stories in the Crypto Roundup today:

- Kraken To Launch Bank ‘Very Soon’

- SEC Files Emergency Action Against BKCoin Over ‘Ponzi-Like’ Scheme

- Binance USD’s Market Cap Plummeted 43% in 30 Days

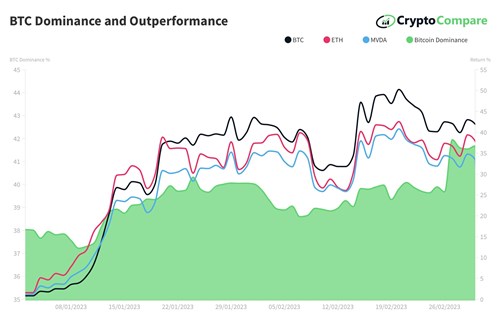

- Chart of the Week: Bitcoin Dominance and Outperformance