Fidelity Digital Assets has quietly opened up Fidelity Crypto access to millions of users, allowing them to trade Bitcoin and Ether commission-free on the platform. Access to the platform was previously restricted to a waitlist.

Leading decentralized exchange Uniswap has officially gone live on the BNB Chain, the smart contract blockchain developed by leading cryptocurrency trading platform Binance. The move means Uniswap is now live on six blockchains.

The Chairman of the U.S. Securities and Exchange Commission (SEC), Gary Gensler, has reiterated his stance that Proof-of-Stake tokens may meet the definition of securities under the Howey Test, and there fall under the agency’s regulatory purview.

Top stories in the Crypto Roundup today:

- Fidelity Crypto Quietly Goes Live

- Leading DEX Uniswap Launches on BNB Chain

- SEC Chairman Suggests Proof-of-Stake Tokens Are Securities

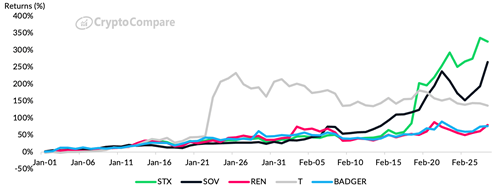

- Bitcoin Associated Tokens Rally Amid Ordinals Hype